nevada estate tax rate

LAS VEGAS KLAS Clark County residents are scrambling to meet the Thursday June 30 deadline to cap the property tax on their primary residence can download a form and submit it electronically. The federal Estate Tax has a progressive rate that starts at 18 and can reach up to 40 significantly decreasing your inheritance.

Taxes In Nevada U S Legal It Group

Nevada also has low property tax rates which will usually be half of 1 to 1 of assessed value.

. No estate tax or inheritance tax. Property owners have two years from the date of the certificate to redeem the property by paying the property taxes and all associated costs in full. There is a federal estate tax that may apply Loading.

Nevada Property Taxes Go To Different State 174900 Avg. RETURN THIS FORM BY MAIL OR EMAIL TO. 1 day agoAll properties not specifically noted as a primary residence will face the 8 tax cap according to Assembly Bill 489.

The top inheritance tax rate is 16 percent no exemption threshold New Mexico. Nevada has a 685 percent state sales tax rate a max local sales tax rate of 153 percent and an average combined state and local sales tax rate of 823 percent. Please contact the administrator or you can send the access request.

The property may be redeemed by payment of taxes and accruing taxes penalties and cost together with interest on the taxes at the rate of 10 percent per annum from the original date due until paid. No estate tax or inheritance tax. Federal estate tax The federal estate tax will be applied if your inheritance is more than 1158 million in 2020 though you will be.

The tax is collected by the county recorder. PO BOX 551401. Thorough estate planning will help you to reduce the taxable part and protect your heirs from a fiscal burden.

Homeowners in Nevada are protected from steep increases in property tax bills by Nevadas property tax abatement law which limits annual increases in property tax bills to a maximum of 3 for homeowners. It is one of 38 states in the country that does not levy a tax on estates. Nevadas statewide real property transfer tax is 195 per 500 of value over 100.

The Auditor-Controller Property Tax Division is responsible for the calculation and preparation of the secured unsecured unitary and supplemental property tax bills. Total Taxable value of a new home 200000. The top estate tax rate is 16 percent exemption threshold.

LAS VEGAS NV 89155-1401. The median property tax in Nevada is 174900 per year based on a median home value of 20760000 and a median effective property tax rate of 084. Nevada has recent rate changes Sat Feb 01 2020.

It can be hand-delivered to the assessors office at 500 S. 5740 million North Carolina. 2 days agoLAS VEGAS KTNV You could be paying more on your property tax than you realize.

You can look up your recent appraisal by filling out the form below. But Nevada does have a relatively high sales tax a state rate is around 7 but goes to approximately 8 when you consider local tax rates. Tax District 200.

In practical terms if you buy a home for 200000 your real estate transfer taxes will only be 780. That price is up 267 year-over-year with 363000 as the total for March 2021. An estate that exceeds the Federal Estate Tax Exemption of 1206 million becomes subject to taxation.

The form is at Temp Tax Cap form 22pdf clarkcountynvgov. FEDERAL ESTATE TAX RATES. There is no estate tax in Nevada.

Nevada Property Taxes Go To Different State 174900 Avg. Compared to the 107 national average that rate is quite low. You may find this information in Property Tax Rates for Nevada Local Governments commonly called the Redbook.

Counties in Nevada collect an average of 084 of a propertys assesed fair market value as property tax per year. Rate Threshold 1 10000. No estate tax or.

With local taxes the total sales tax rate is between 6850 and 8375. 500 S GRAND CENTRAL PKWY. Under state law as a property owner you can apply for a three percent tax cap on your primary residence.

Condos and townhomes in March sold for 270000 a 392 increase from 194000 last year. Each states tax code is a multifaceted system with many moving parts and Nevada is no exception. Some counties in Nevada such as Washoe and Churchill add 010 to the rate.

Nevadas tax system ranks 7th overall on our 2022 State Business Tax Climate Index. I will notify the Assessor if the status of this property changes. Officials note that if your.

CLARK COUNTY ASSESSOR. Tax Rate 32782 per hundred dollars. Clark County adds 060.

Nevada NV Sales Tax Rates by City The state sales tax rate in Nevada is 6850. NRS 3614723 provides a partial abatement of taxes. For more information contact the Department at 775-684-2000.

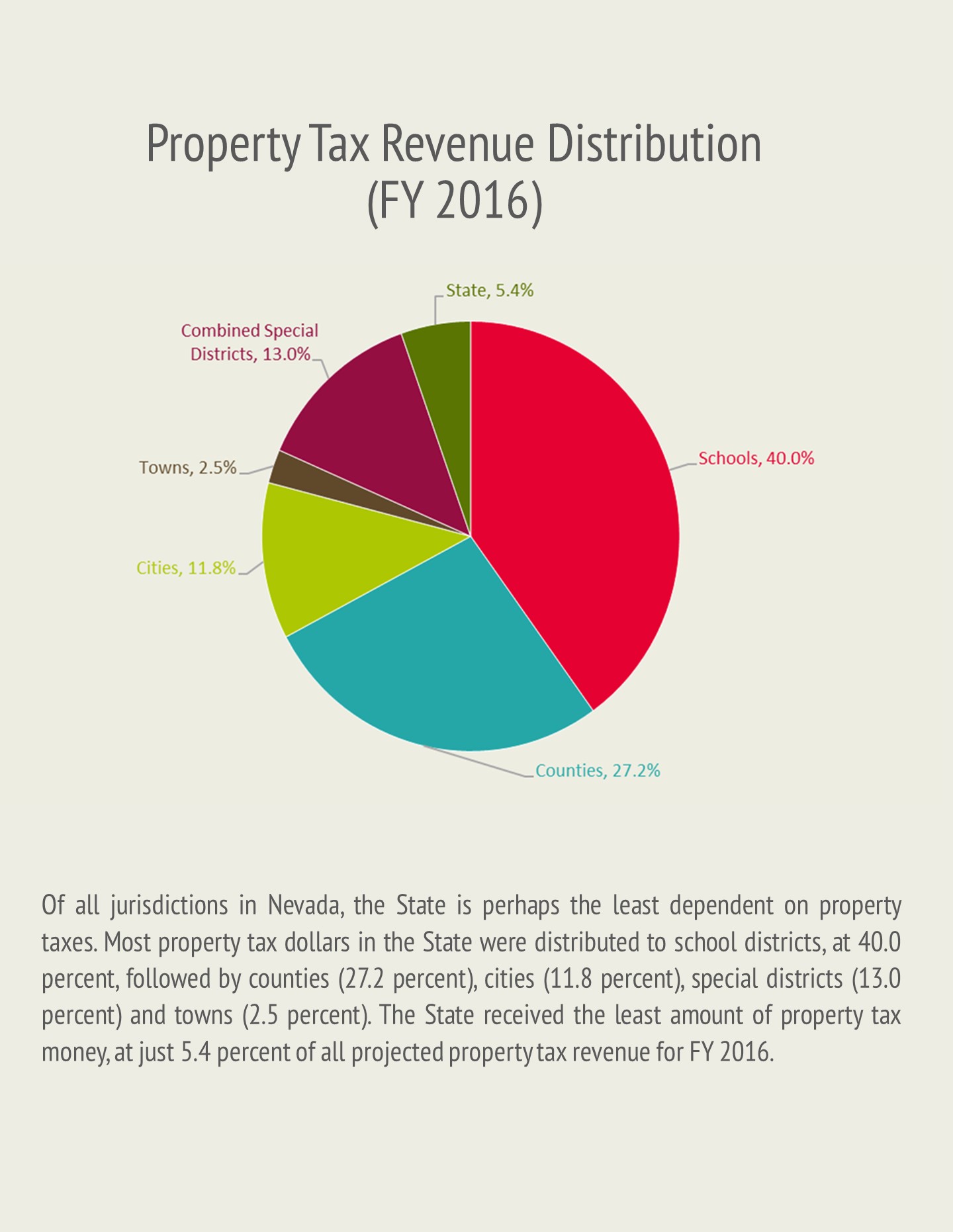

Assessment Ratio 35. 084 of home value Tax amount varies by county The median property tax in Nevada is 174900 per year for a home worth the. Property Tax Rates for Nevada Local Governments Redbook NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues generated by those taxes.

Sets the current and delinquent tax rates. Select the Nevada city from the list of popular cities below to see its current sales tax rate. The states average effective property tax rate is just 053.

No estate tax or inheritance tax. Statistics for March 2022 show that the median price of single-family homes sold in the valley was 460000 breaking Februarys record. Homeowners in Clark County are facing a fast-approaching deadline to save some money on property taxes.

22 hours agoIn Nevada the property tax for someones primary residence is a maximum of 3 percent and the property tax for other properties including land and commercial buildings is a max of 8 percent. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Nevada City CA 95959.

From Fisher Investments 40 years managing money and helping thousands of families. Below you will find an example of how to calculate the tax on a new home that does not qualify for the tax abatement. Property taxes for primary residences in the county are capped with state law saying they.

084 of home value Tax amount varies by county The median property tax in Nevada is 174900 per year for a home worth the median value of 20760000. As Percentage Of Income. Taxable Estate Base Taxes Paid.

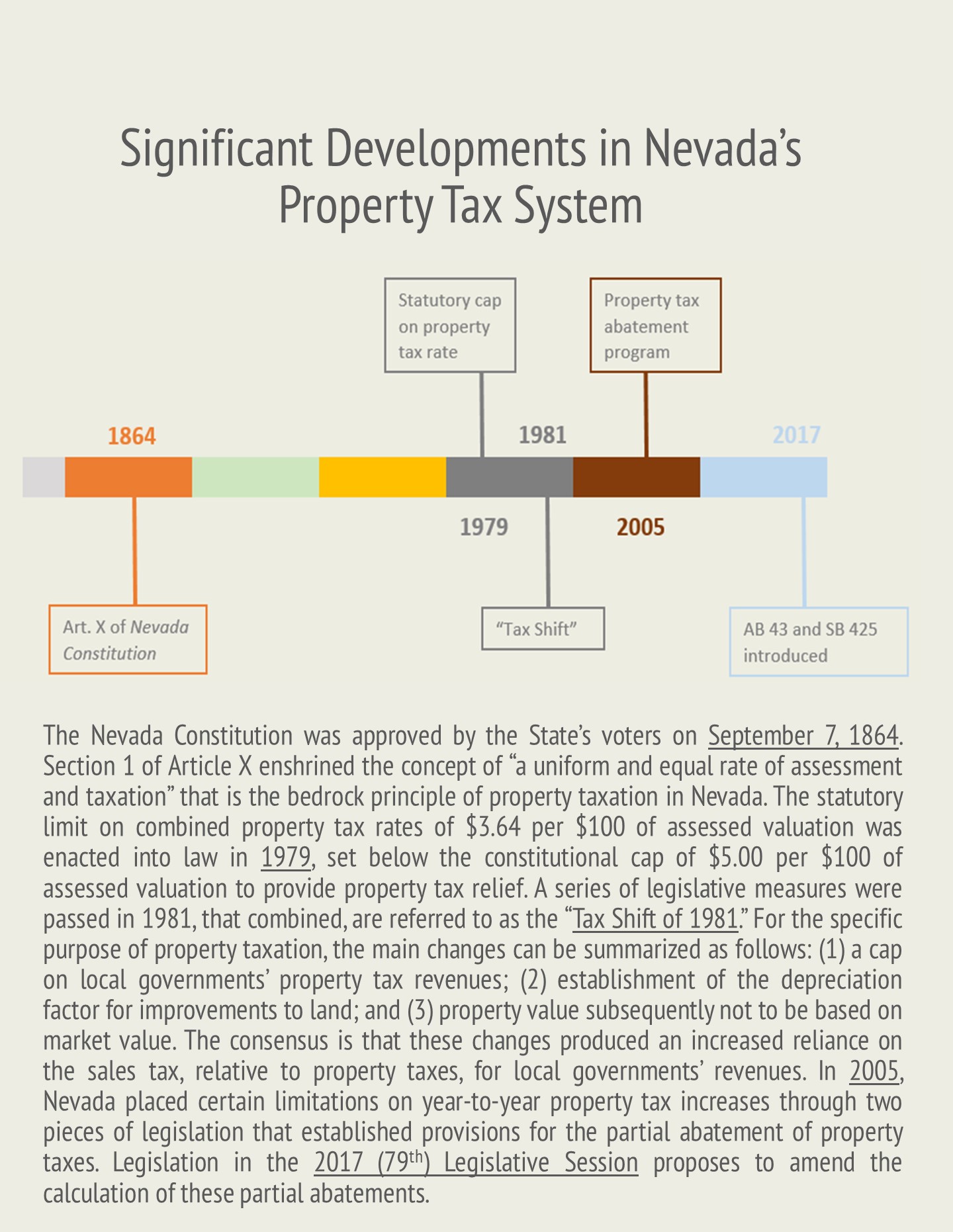

If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing until which time the Internal Revenue Service reenacts the Death Tax Credit Nevada that was collected prior to January 1 2005. Grand Central Parkway. Your current security role has been changed.

Property Taxes In Nevada Guinn Center For Policy Priorities

Taxes In Nevada U S Legal It Group

How To Start An Llc In Nevada Llc Business Annual Report Estate Planning Attorney

Taxpayer Information Henderson Nv

Nevada Tax Rates And Benefits Living In Nevada Saves Money

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map

Property Taxes In Nevada Guinn Center For Policy Priorities

How High Are Cell Phone Taxes In Your State Tax Foundation

Taxpayer Information Henderson Nv

Nevada Property Tax Calculator Smartasset

Property Taxes In Nevada Guinn Center For Policy Priorities

City Of Reno Property Tax City Of Reno

Nevada Inheritance Laws What You Should Know

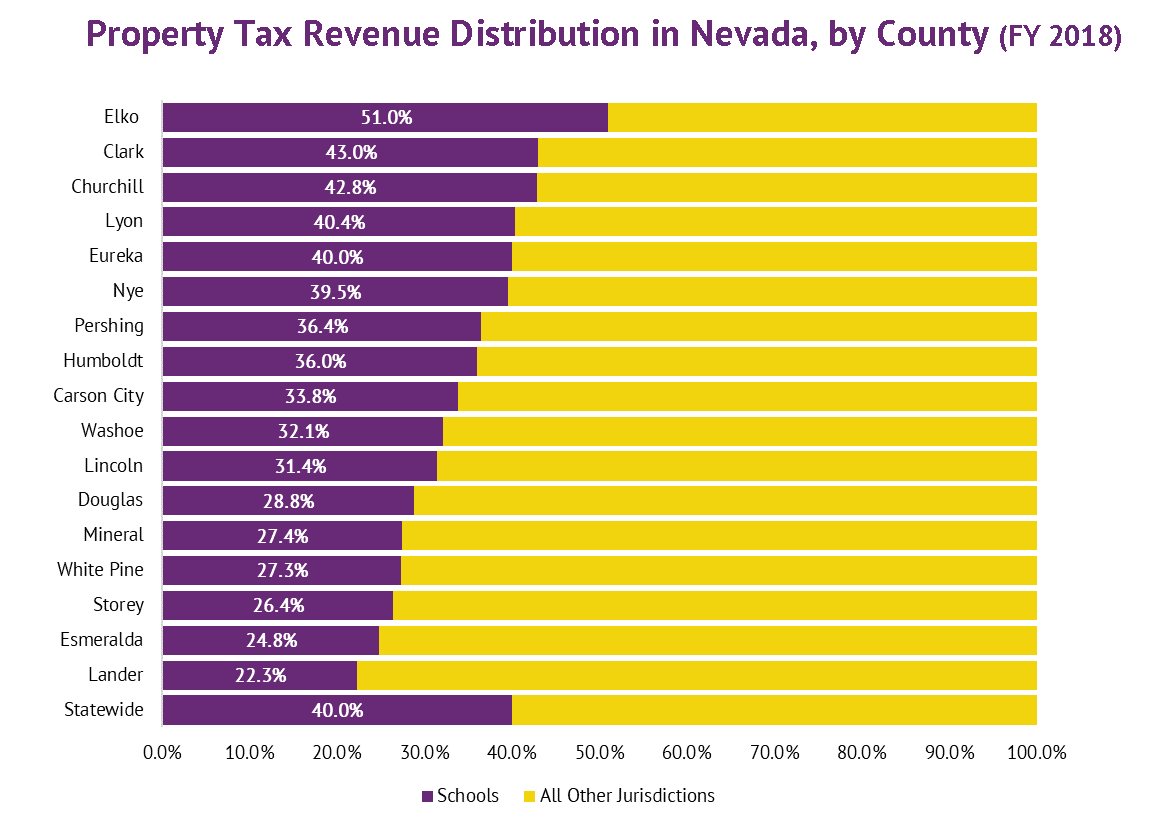

Property Taxes K 12 Financing In Nevada Guinn Center For Policy Priorities

Property Taxes In Nevada Guinn Center For Policy Priorities

Property Taxes K 12 Financing In Nevada Guinn Center For Policy Priorities